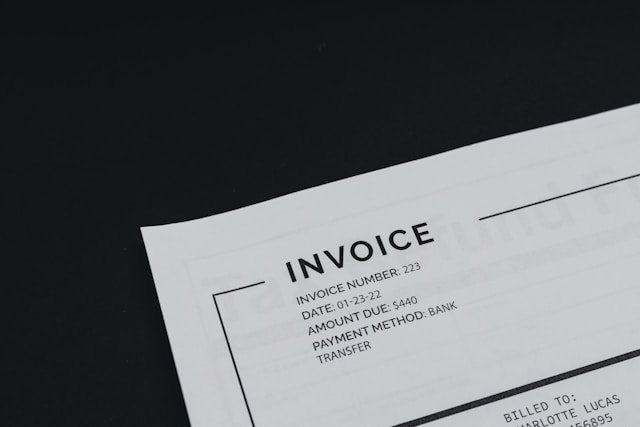

Make A Payment

Resolve Your Debt And Make a Payment Today

How to Pay Off Your Debt In An Easy Way?

Paying off debt can often seem daunting, but approaching it strategically can simplify the process and reduce your financial burden. Start by listing all your debts, noting their interest rates and balances.

Focus on either the debt with the highest interest rate (the avalanche method) or the smallest balance (the snowball method) to begin making extra payments.

Creating a budget is crucial; it will help you identify unnecessary expenses you can cut back on to allocate more money towards your debt.

Payment By Post

To facilitate your payment, you have the option to send a cheque via postal mail.

Please make the cheque payable to “business Debt Recovery” and on the back of the cheque write you name and reference number. Send the cheque to the address provided below. It is advisable to obtain proof of postage and any additional confirmation of submission to avoid unnecessary site visits.

Unit 22 Cariocca Business Park, 2 Sawley Road, Manchester, England, M40 8BB

After the cheque is processed, you will receive a validated receipt from our office.

Make payment via online banking

We recommend utilising online banking services to ensure a safe and encrypted transfer of your payment to Business Debt Recovery.

Please refer to the account information provided in your previous correspondence. Please include your unique reference code for proper identification when initiating the payment.

If you cannot locate your letter containing the necessary details, please contact us via email at info@businessdebtrecovery.uk. Our team will get back to you.

For Payment By Cash, Please Follow These Steps

Prepare the cash

Gather the exact amount of cash needed for your payment. Ensure that you have the appropriate denominations and any necessary changes.

Get In Touch

To settle your debt with cash, please get in touch with the Business Debt Recovery head office at 0161 832 1399 and get your unique reference number. We will arrange for a field agent to collect the cash from you.

Obtain a receipt

After making the cash payment, you will receive an official receipt for your records. The receipt should include the payment amount, date, and any other relevant details. Keep this receipt for your records.

Make Your Payment Securely Through A Standing Order

Set Up Standing Order

Contact your bank to set up a standing order. Provide them with the details of the recipient (creditor), including their name, account number, and sort code. You will also need to specify the amount to be paid.

Provide Reference Detail

When making payments toward your debt, include a unique reference code or account number. The number acts as a fingerprint for your debt, ensuring that the money you send is matched to your account.

Set Payment Frequency

Determine the payment schedule based on your financial situation and the terms of your debt agreement. Standing orders can be set up for regular fixed amounts or variable amounts if your debt repayment varies.

Maintain Funds

Ensure that you have sufficient funds in your account to cover the standing order payments. If there are insufficient funds, the payment may be missed, potentially resulting in additional fees.

Monitor Payments

Regularly monitor your bank statements to ensure payments are made as scheduled. If you notice any payment discrepancies or issues, contact your bank promptly to address them.

Review Periodically

Periodically review your standing order arrangement to ensure that it aligns with your current financial situation and the terms of your debt agreement. Adjust the payment amount as necessary.